The Chase Sapphire Preferred® is a popular credit card among travelers and rewards enthusiasts for its valuable benefits and flexible redemption options. In this article, we will explore the features of the Chase Sapphire Preferred® card and how it can be a great addition to your wallet.

The Chase Sapphire Preferred® is often touted as an exceptional starter card for those looking to dip their toes into the world of travel rewards. One of its key features is the ability to earn transferrable Ultimate Rewards points, which can be transferred to Chase’s airline and hotel partners for maximum value.

One of the advantages of the Chase Sapphire Preferred® is its ability to pair well with other Chase cards, such as the Chase Freedom Flex℠and Chase Freedom Unlimited® or the business versions: Ink Business Cash® , Ink Business Unlimited®. By combining the points earned on these cards with those from the Chase Sapphire Preferred®, cardholders can maximize their rewards potential and unlock even more value.

One of the standout features of the Chase Sapphire Preferred® is its relatively low annual fee of $95. Despite this, cardholders still receive a 10% anniversary bonus on points earned throughout the year, adding extra value to the card. Additionally, cardholders also receive a $50 hotel credit when booking through the Chase travel portal, further enhancing the overall value of the card.

In terms of earning potential, the Chase Sapphire Preferred® offers 2x points on travel and dining purchases, making it a great card for those who frequently spend in these categories. Additionally, cardholders also earn 1x points on all other purchases, providing a solid baseline for earning points on everyday spending.

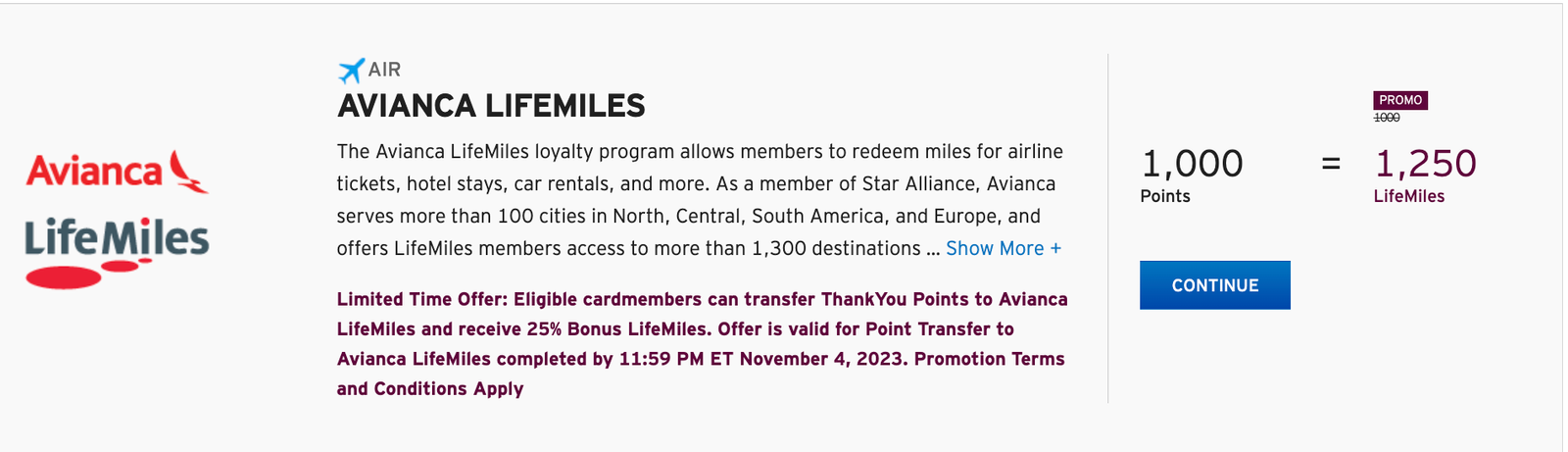

When it comes to redemption options, the Chase Sapphire Preferred® offers a variety of ways to use your points. One of the most popular options is to transfer points to Chase’s airline and hotel partners, such as United Airlines, Southwest Airlines, Hyatt, and Marriott. By transferring points to these partners, cardholders can often unlock higher redemption values and access exclusive benefits.

Another popular redemption option is to redeem points through the Chase travel portal, where points can be used to book flights, hotels, car rentals, and more. Points are typically worth 1.25 cents each when redeemed through the portal, providing a solid value for cardholders looking to maximize their rewards.

In addition to these redemption options, cardholders can also use points to pay for purchases directly through the Chase Ultimate Rewards portal, or redeem for cash back or gift cards. This flexibility allows cardholders to tailor their redemption strategy to their individual preferences and travel goals.

Overall, the Chase Sapphire Preferred® is a versatile and valuable credit card that offers a range of benefits for travelers and rewards enthusiasts. With its generous earning potential, flexible redemption options, and valuable perks, the Chase Sapphire Preferred® is a solid choice for those looking to maximize their rewards and travel experiences.